In recent years, the silver to gold ratio has received greater attention. This is likely because of increasing realization that the ratio seems to directly contradict price levels. Such realization is augmented by the fact that much of the silver mined today is used industrially, rendering it much more difficult to recover.

Though silver has enjoyed a place in monetary as well as jewelry use for millennia, as technology has increased, so too has silver's diversity. Its demands now include photography, electronics, superconductivity, water purification and medical use. Out of a total supply of 1.057 billion ounces (>36,000 tons), including scrap and government sales, the major breakdown in silver usage in 2010 is as follows (in millions of ounces).

| Industrial | 487 |

| Photography | 72 |

| Jewelry | 167 |

| Silverware | 50 |

| Coins and Medals | 101 |

| Remainder1 | 180 |

1Implied investment or stockpiling

Out of this 1.057 billion ounces, approximately 0.736 billion (70%) are from mine production. With 560 million ounces being consumed through industrial use, including photography, current mining efforts are relegated to an increase of only 176 million ounces (>6,000 tons).

Current stockpiles can't possibly meet demand forever. In fact, many claim that silver stores have been depleted at an alarming rate.

While the ratio of silver to gold available in the earth's crust is estimated anywhere from 25/1 to 18/1, the silver to gold production ratio is only about 8/1. This is because silver, with a few exceptions, is generally a by-product that's refined in the pursuit of gold, copper and other metals.

Rounding overall availability of silver to 20/1 in relation to gold, for simplicity, silver's value should have been approximately $50 when gold was $1,000 and $100 when gold reaches $2,000. According to production alone, if the market value of silver were equal to its availability in relation to gold, it would have been $100 when gold reached $800, and $200 when gold reached $1,600.

However, as noted, silver has extensive industrial uses while gold does not. What is impossible to tell is how much above ground silver still exists in stockpiles around the world. It is estimated that a total of 40 billion ounces (1.37 million tons) of silver have been mined in human history.

Of this 40 billion, almost 6 billion (15%) has been consumed through industrial use in the past decade. How much was consumed in previous decades is difficult to tell. In an effort to avoid over-sensationalizing our numbers, we'll use a very conservative estimate of 37.5% total industrial consumption. This would leave us with 25 billion total ounces of silver (857,000 tons).

From this perspective, in relation to the estimated 178,000 tons of gold in the world, the silver to gold ratio would be about 4.8/1. In other words, if gold were $2,000 per ounce, this ratio would dictate $416 per ounce silver.

The silver-to-gold price ratio is a straightforward equation that anyone can watch when considering which of these two metals to invest in. Additionally, there are different ideas about what would be the best trade in relation to the ratios.

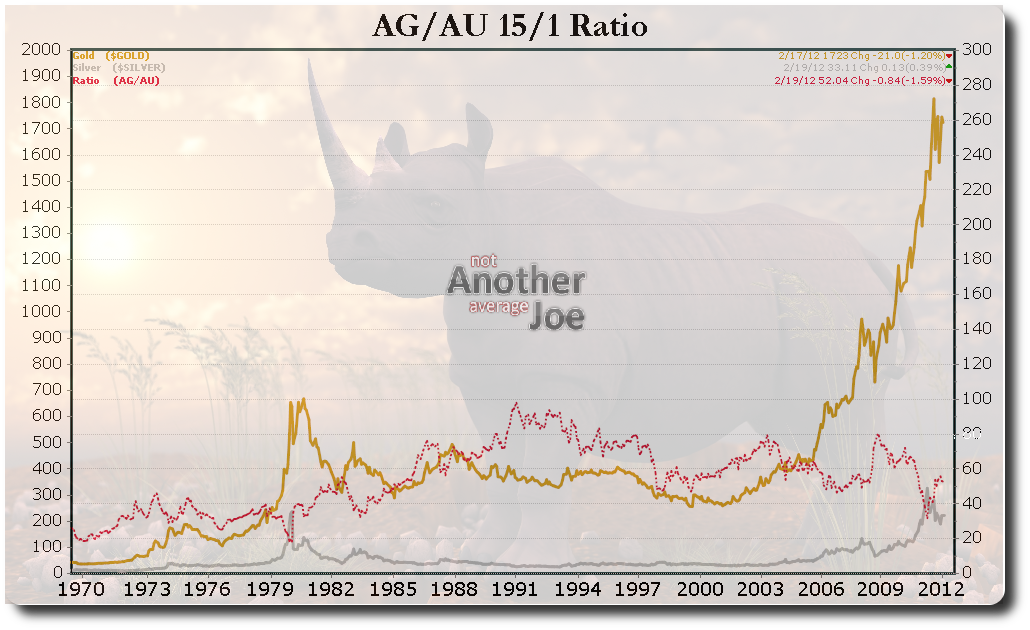

In recent years, the ratio has changed dramatically, moving as high as 80/1 about three years ago. Of course, even 80/1 is a bit shy of the 100/1 high of February 91, but still higher than even 20 year averages. On the other hand, during the past 35 years the historical average of about 16/1 had only been approached once, in January, 1980, when it bottomed at 17/1.

click to enlarge

The chart above is based on a 15/1 silver to gold ratio. If the ratio had remained consistent, the silver and gold lines would more closely approximate one another. The red line represents the gold to silver ratio, associated with the right (silver) side of the chart.

In order to trade the ratio, the goal is to buy silver bullion or bags, pick a ratio that you're convinced is an equitable ratio to begin trading, and then move from silver to gold. Perhaps one would move 25% of their silver to gold when the ratio is 40/1, another 25% at 30/1, 25% at 20/1 and hold 25% just in case it dips lower. Then, as ratios move up the opportunity presents itself to move back into silver. Upward trades might begin at 30 or 40/1, again in increments, holding a little gold just in case the ratio moved up above 80/1 again. This is a viable ETF trading strategy as well, with gold (IAU), GLD, PHYS, SGOL) and silver (SLV),PSLV, SIVR) trades easily accessible (Not all of these are alike. Investigate differences to decide which best suits your goals). Because silver is much more volatile than gold, it is possible for these opportunities to manifest themselves only briefly.

Only time will tell if silver will gain to reach the 5/1 ratio. And it's impossible to know, at this point, where these ratios will eventually equilibrate. This particular strategy, percentages and the numbers suggested are merely for your consideration. Trading amounts and ratios to pursue are subject to your own philosophy, goals and comfort level. Perhaps this style of investing isn't right for you. Maybe your ratios would be lower or higher. All of this can be highly subjective, with only hindsight affording 20/20 vision (though even then misinformation can alter perceptions).

CONCLUSION

Understand the silver-to-gold ratio. Availability in the ground is around 20/1, depending upon whose chart you prefer. But mining ratios are only about 8/1. Existing supplies appear to be less than 5/1. Current price levels are about 55/1.

Whether through personal possession or ETFs, a strategy can be developed to trade the ratios when they offer an opportunity. Some storage facilities may offer trading opportunities as well.

http://seekingalpha.com/article/393651-silver-and-gold-trading-the-ratio

http://seekingalpha.com is a reliable website in terms of investment advice and articles on economic events and analysis.

Comments