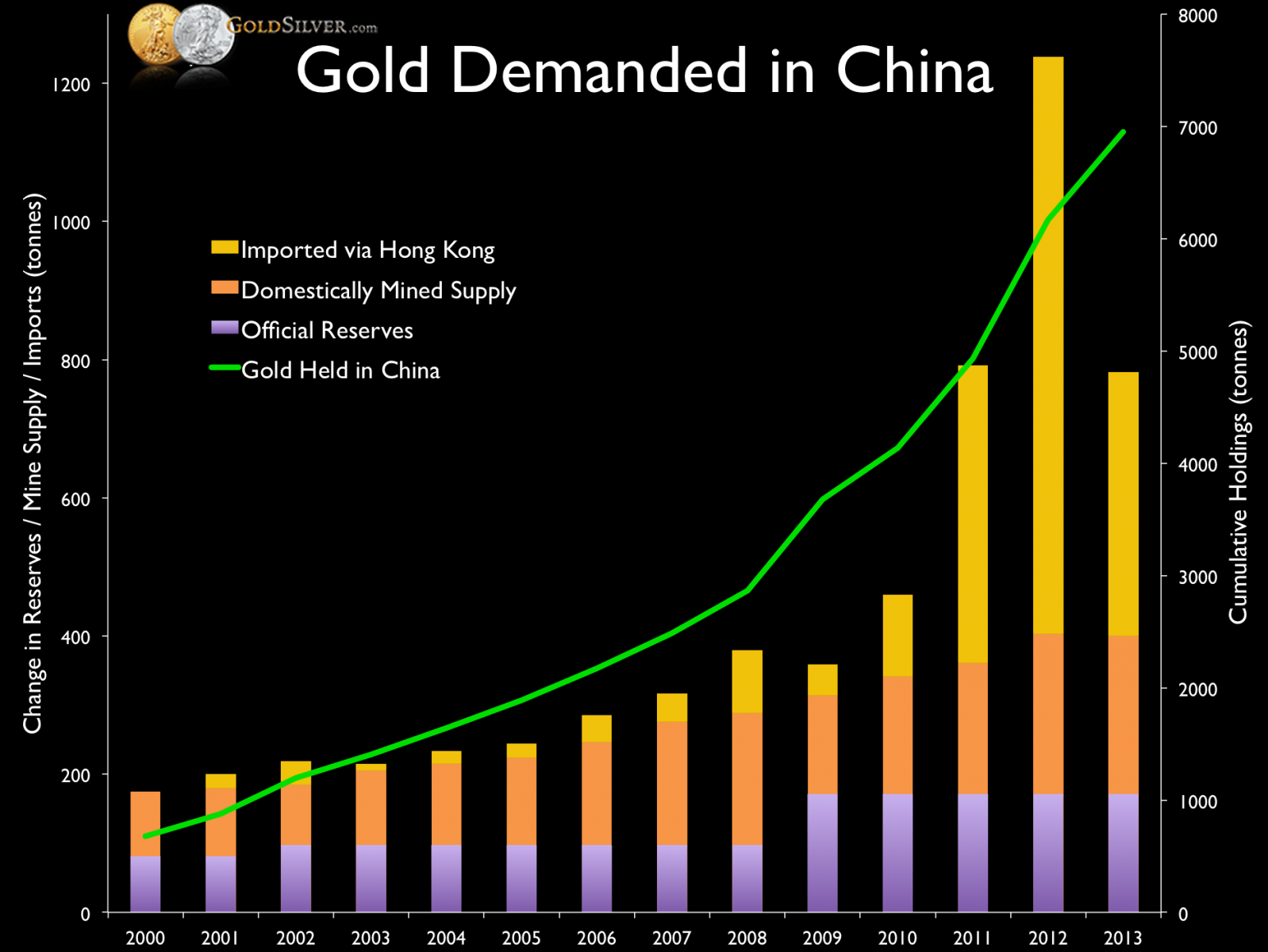

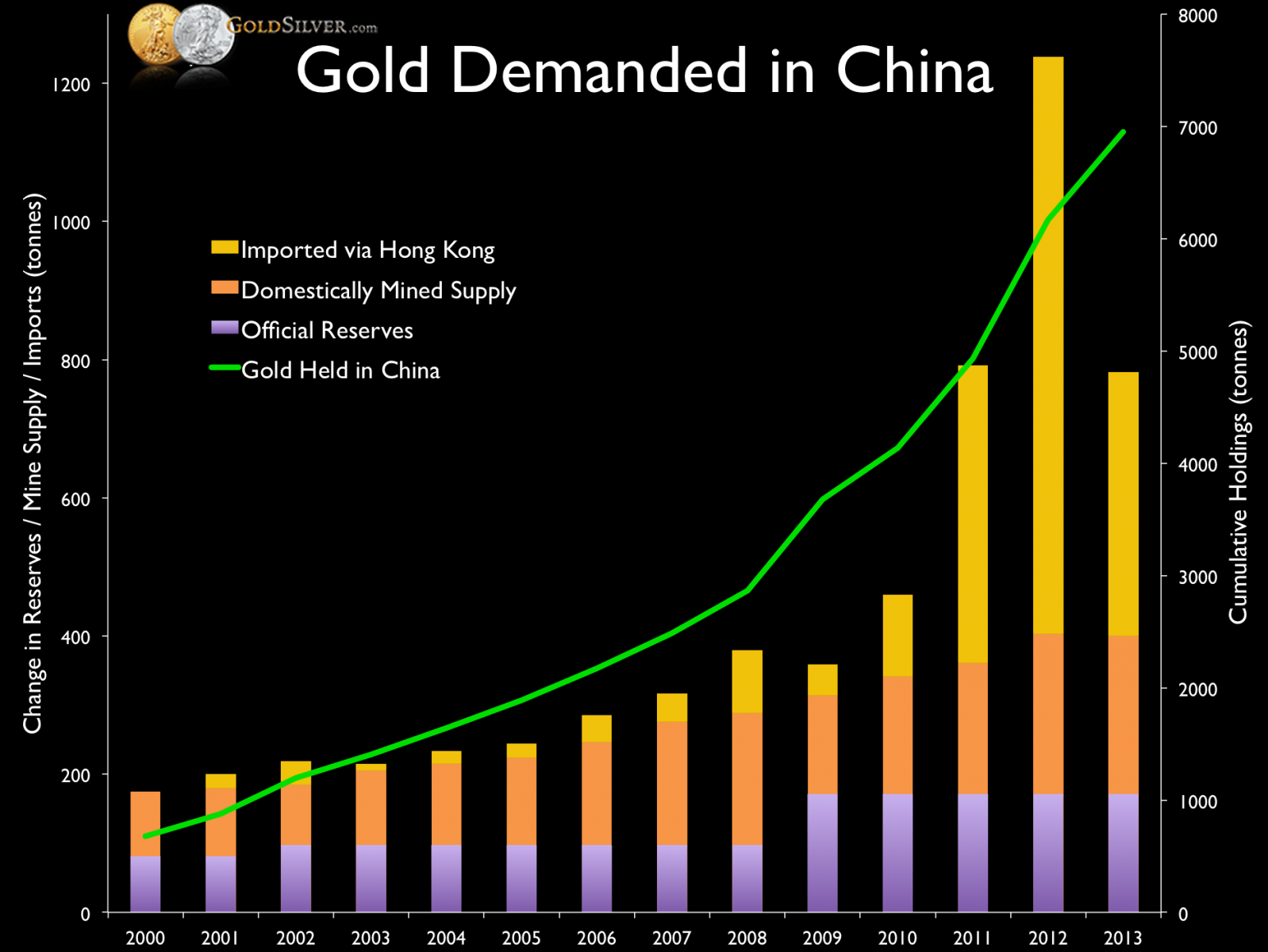

Analysts believe China bought as much as 490 tons of gold in 2011, double the estimated 245 tons in 2010. “The thing that’s caught people’s minds is the massive increase in Chinese buying,” remarked Ross Norman of Sharps Pixley, a London gold brokerage, this month.

So who in China is buying all this gold?

The People’s Bank of China, the central bank, has been hinting that it is purchasing. “No asset is safe now,” said the PBOC’s Zhang Jianhua at the end of last month. “The only choice to hedge risks is to hold hard currency—gold.” He also said it was smart strategy to buy on market dips. Analysts naturally jumped on his comment as proof that China, the world’s fifth-largest holder of the metal, is in the market for more.

From: http://www.forbes.com/sites/gordonchang/2012/01/29/why-are-the-chinese-buying-record-quantities-of-gold/2/

Ref:

http://www.proactiveinvestors.com/columns/casey-research/3417/zero-hedge-mocks-cftcs-supposed-concern-about-gold-and-silver-market-rigging-3417.html

Ref http://goldsilver.com/article/223-5-metric-tons-of-gold-imported-into-china-in-march/

Ref http://online.wsj.com/article/SB10001424052702303812904577297891527124790.html

Ref:

http://www.proactiveinvestors.com/columns/casey-research/3417/zero-hedge-mocks-cftcs-supposed-concern-about-gold-and-silver-market-rigging-3417.html

Ref http://goldsilver.com/article/223-5-metric-tons-of-gold-imported-into-china-in-march/

Ref http://online.wsj.com/article/SB10001424052702303812904577297891527124790.html

Building up gold reserves will be crucial to China as it moves to internationalize its currency, and hopes to make it a reserve currency, according to the Financial Times.

Read more: http://www.businessinsider.com/countries-with-largest-gold-reserves-2013-4?op=1#ixzz2Xj0cx4Ft

Read more: http://www.businessinsider.com/countries-with-largest-gold-reserves-2013-4?op=1#ixzz2Xj0cx4Ft

Italy "Could Use Gold Bullion as Alternative to Austerity"Thursday, 5/02/2013 11:58

A SMALL majority of Italians would favor using the country's gold bullion reserves to ease the national debt burden, according to a new report from the World Gold Council, the market development organization for the gold market.

Citing the results of an Ipsos-MORI survey of individuals and Italian business leaders conducted in March, the WGC reports that "52% of Italians and 61% of business leaders would endorse using, but not selling" Italy's gold as a way of lowering the debt burden and helping to spur economic growth.

The report, entitled 'Italy considers gold as an alternative to austerity', adds that only 4% of survey respondents would support an outright sale of gold bullion.

Also see:

Comments