Who should you trust - the Federal Reserve or all of the half-crazed bloggers out there that are warning about the "serious doom" that is coming.

Well, come back to this article in a year or two and compare how accurate the predictions were.

In the end, time will tell who is telling lies and who is not.

If we do not learn from history, we are doomed to repeat it.

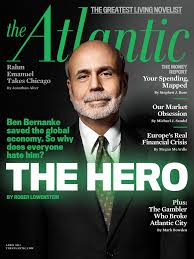

For example, let's take a quick look at Ben Bernanke's track record over the past several years.

The following are statements that Bernanke actually made to the public....

#1 (July, 2005) "We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though."

#2 (October 20, 2005) "House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals."

#3 (November 15, 2005) "With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly."

#4 (February 15, 2006) "Housing markets are cooling a bit. Our expectation is that the decline in activity or the slowing in activity will be moderate, that house prices will probably continue to rise."

#5 (February 15, 2007) "Despite the ongoing adjustments in the housing sector, overall economic prospects for households remain good. Household finances appear generally solid, and delinquency rates on most types of consumer loans and residential mortgages remain low."

#6 (March 28, 2007) "At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency."

#7 (May 17, 2007) "All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable."

#8 (January 10, 2008) "The Federal Reserve is not currently forecasting a recession."

#9 (June 10, 2008) "The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so."

But don't worry, Ben Bernanke insists that he knows exactly what is going on this time.

So do you believe him?

A lot of Americans don't. In fact, an "economic collapse" is the number one catastrophic event that Americans worry about according to one recent survey.

Perhaps that is one reason why so many Americans are preparing for doomsday these days.

The central planners over at the Federal Reserve are not going to solve our economic problems.

The truth is that the Fed is at the very heart of our economic problems.

We have been living in the greatest debt bubble in the history of the world and that debt bubble has been facilitated by the Fed.

Over the past three decades, the total amount of debt in America has increased by about 50 trillion dollars. By stealing from future generations, we have been able to live like kings and queens, but there is going to be a great price to pay for our foolishness.

Ben Bernanke and the other folks running the Federal Reserve are just going to keep insisting that everything is going to be okay for as long as they possibly can. They are going to tell you that they know exactly how to fix things and that the economy will be back on track very soon.

Don't be stupid and believe them this time.

Also

Caught in the Act: Bald-Faced Lying By a Federal Reserve Official

Even if a government official sees a serious crisis developing, the official will not necessarily tell the public. The official will do what is in the best interest of the government agency, he/she represents--and lie to the public about his/her real views.

But among them, the quickest to stress the severity of the housing downturn was Janet Yellen. Then president of the Federal Reserve Bank of San Francisco.

What did Yellen say during 2007 FOMC meetings? Kurtz reports (gray shaded areas):

Yellen started sounding the alarm bells in May 2007.

"Much of the first-quarter weakness, of course, was due to housing, and I really don't see that sector starting to turn around at this point," she said.A month later, she again cautioned about the housing market.

"In terms of risks to the outlook for growth, I still feel the presence of a 600-pound gorilla in the room, and that is the housing sector. The risk for further significant deterioration in the housing market, with house prices falling and mortgage delinquencies rising further, causes me appreciable angst."

This is all quite interesting, but what is more interesting is what Yellen was telling the public during the same period.

As she was expressing concern about a "600-pound gorilla in the room," in the private FOMC meetings, just seven days later on July 5, 2007 in a speech delivered to the First Annual Conference of the Risk Management Institute Singapore via video-conference, she said:The bottom line for housing is that it has had a significant depressing effect on real GDP growth over the past year. While I wouldn't want to bet on a sizable upswing, I also wouldn't be surprised to see it begin to stabilize late this year or next. Furthermore, if and when it does stabilize, it could contribute to a pickup in overall growth in the future, as the negative force of its contraction turns neutral.On July 12, 2007, in a speech to a Community Leaders Luncheon in Anchorage, Alaska, she said:

As many of you probably know, the Federal Open Market Committee last met on June 27 and 28 and voted to hold the federal funds rate, our main policy tool, unchanged at 5¼ percent. To most observers of the Fed, the decision probably had a familiar ring to it, because the funds rate has been kept at that level for the last twelve months. Indeed, my views concerning the logic of this decision will also have a familiar ring to anyone who has heard me discuss monetary policy during the past year. To my mind, the reason for adopting and maintaining the current stance of policy is that it promises to keep the overall economy on an adjustment path where growth is moderate and sustainable. The virtues of this path are that it avoids exposing the economy to unnecessary risk of a downturn, while, at the same time, it is likely to produce enough slack in goods and labor markets to relieve inflationary pressures. I believed a year ago, and still believe now, that such a path is likely and will enable us to achieve our dual mandate—low and stable inflation and maximum sustainable employment.[...]Tighter credit to the subprime sector and foreclosures on existing properties have the potential to deepen the housing downturn. I am nonetheless optimistic that spillovers from this sector will be limited, because these mortgages represent only a small part of the overall outstanding mortgage stock.

In August, she expressed "appreciable angst" at an FOMC meeting:

"The housing sector obviously remains a serious concern. We seem to be repeatedly surprised with the depth and duration of the deterioration in these markets; and the financial fallout from developments in the subprime markets, which I now perceive to be spreading beyond that sector, is a source of appreciable angst."

Later in the month, she added this:

We've developed a credit crunch. If liquidity isn't quickly restored in these markets, we are looking at a credit crunch—signs of it are everywhere.... Every day we hear about companies that are trying to finance prime quality jumbo mortgages and cannot get the financing to do that and are tightening standards."

Then at the September 18 FOMC meeting she said:

"A big worry is that a significant drop in house prices might occur in the context of job losses, and this could lead to a vicious spiral of foreclosures, further weakness in housing markets, and further reductions in consumer spending... At this point I am concerned that the potential effects of the developing credit crunch could be substantial."

But publicly, eleven days earlier, on September 7, 2007, Yellen delivered a speech to the National Association for Business Economics in San Francisco, California. In that speech, there was no talk of a vicious spiral. She said:

While I do think that the present financial situation has added appreciably to the downside risks to economic activity, we should remember that conditions can change quickly for better or for worse—especially in financial markets—so it’s hard right now to speak with a great deal of confidence about future economic developments. It’s also important to maintain a sense of perspective: past experience does show that financial turbulence can be resolved more quickly than seems likely when we’re in the middle of it. Moreover, the effects of these disruptions can turn out to be surprisingly small.

ref

Comments